Nepal’s digital payment landscape underwent a seismic shift in 2025, with the country’s first-ever digital wallet merger making headlines and reshaping the entire industry. From paying your electricity bills to sending money to friends, digital wallets have become an essential part of daily life for millions of Nepalis. But with so many options available, which one should you choose?

Let’s dive deep into Nepal’s digital wallet ecosystem, exploring everything from the market leaders to emerging players, and understand how recent developments are changing the game.

The Game-Changing Merger: IME Pay and Khalti Unite

The biggest news in Nepal’s fintech space this year has been the historic merger between IME Pay and Khalti, marking Nepal’s first-ever digital wallet merger. Nepal Rastra Bank (NRB) has given final approval for the merger, confirmed by Amit Agarwal, Director of Khalti Digital Wallet.

This isn’t just a simple business deal; it’s a strategic move that could completely reshape Nepal’s digital payment landscape. Despite IME Pay’s higher paid-up capital of Rs 300 million compared to Khalti’s Rs 50 million, Khalti is believed to hold a larger share of the digital wallet market. The merged entity will likely be called “IME Khalti,” though discussions are still ongoing regarding the top-level management structure.

What makes this merger so significant? The merger is seen as a strategic effort to combine their strengths, Khalti’s extensive user base and IME Pay’s financial backing. Together, they’re positioning themselves as a formidable challenger to eSewa’s market dominance.

Why This Merger Matters

Before the merger, Nepal’s digital wallet market was dominated by three major players: eSewa, Khalti, and IME Pay. Now, with two of these giants joining forces, we’re looking at a potential duopoly that could drive innovation, improve services, and offer better value to consumers.

The combined entity brings together:

- Khalti’s strengths: Extensive user base, user-friendly interface, and strong brand recognition

- IME Pay’s advantages: Robust financial backing, strong remittance services, and institutional partnerships

Market Leader: eSewa – The Pioneer That Still Dominates

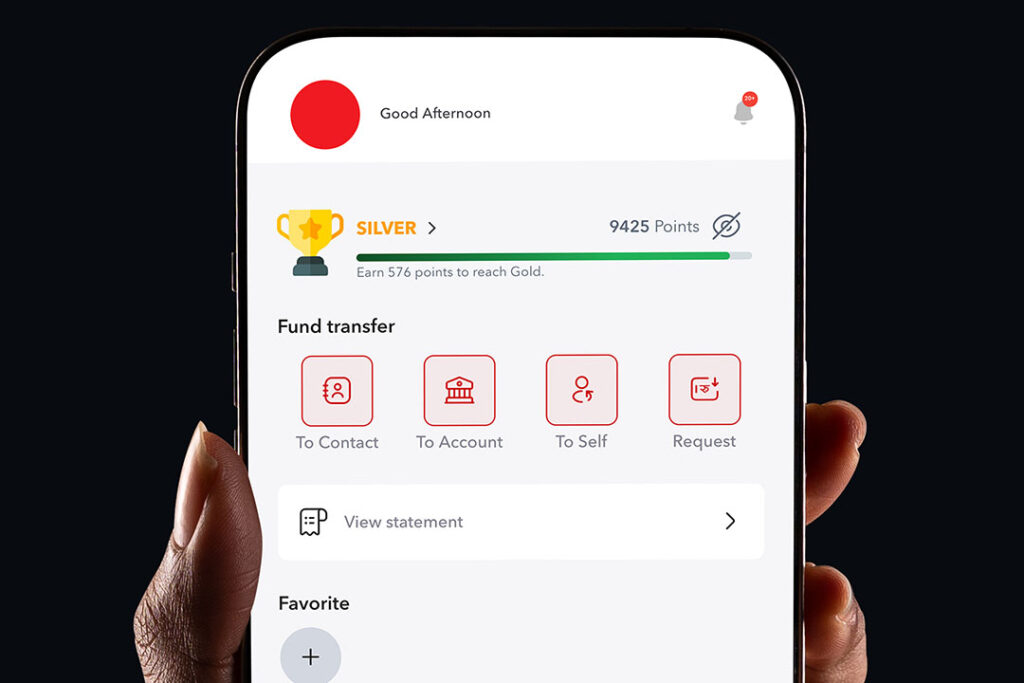

eSewa should be the top digital wallet in Nepal in 2025, with its range of services, ubiquitous presence in the market, and number of users. As Nepal’s first and most established digital wallet, eSewa has maintained its market leadership through consistent innovation and comprehensive service offerings.

What Makes eSewa Special:

- Comprehensive Services: From utility bill payments to movie tickets, eSewa covers almost every digital payment need

- Merchant Network: Partnerships with over 50 banks and thousands of cooperatives

- Trust Factor: Being the pioneer in the space, eSewa has built tremendous trust among users

- Regular Updates: Continuous feature additions and improvements keep users engaged

Popular eSewa Features:

- Mobile and internet bill payments

- Electricity bill payments (NEA)

- Online shopping payments

- Fund transfers

- Bus and airline ticket bookings

- Movie ticket purchases

- Insurance premium payments

eSewa’s longevity in the market has given it a significant advantage in terms of user adoption and merchant acceptance. However, the IME Pay-Khalti merger poses the first serious challenge to its dominance.

The Reliable Alternative: Fonepay

Fonepay has carved out its niche in Nepal’s digital payment ecosystem by focusing on interbank transactions and QR-based payments. Fonepay Nepal offers secure digital payment with QR payments, fund transfers, bills, and virtual credit card services.

Fonepay’s Unique Selling Points:

- Interbank Focus: Strong connections with Nepal’s banking system

- QR Code Payments: Pioneered QR-based payments in many merchant locations

- Virtual Credit Cards: One of the few services offering virtual card solutions

- Bank Integration: Seamless integration with traditional banking services

Why Choose Fonepay:

- Better integration with existing bank accounts

- Strong security features

- Growing merchant acceptance

- Reliable customer support

The Emerging Players: New Wallets Making Their Mark

Nepal’s digital wallet space isn’t just about the big three anymore. Several newer players are making their presence felt, each targeting specific niches or demographics.

MoruPay: The User-Friendly Newcomer

MoruPay has entered the market with a focus on simplicity and user experience. While still building its user base, it’s gaining traction among younger users who appreciate its clean interface and straightforward approach.

MoruPay Features:

- Simple, intuitive interface

- Basic utility payments

- Person-to-person transfers

- Growing merchant network

PrabhuPay: Leveraging Existing Infrastructure

PrabhuPay benefits from the Prabhu Group’s existing financial services infrastructure, particularly in money transfer and remittance services. This gives it a unique advantage in certain segments of the market.

PrabhuPay Advantages:

- Strong remittance service background

- Established financial services infrastructure

- Focus on reliability and security

- Growing feature set

NPay and Other Emerging Wallets

Several other digital wallets are competing for market share:

- NPay: Focusing on specific utility payments and local services

- Various Bank-Specific Wallets: Many banks have launched their digital wallet solutions

- Niche Players: Specialized wallets targeting specific industries or demographics

Comparing the Major Players: Which One is Right for You?

For Comprehensive Services: eSewa

Choose eSewa if you want:

- The most comprehensive range of services

- Highest merchant acceptance

- Proven reliability and security

- Regular feature updates and improvements

For Innovation and User Experience: IME Khalti (Post-Merger)

The merged entity is ideal if you want:

- Cutting-edge features and innovation

- Strong financial backing

- Competitive rates and offers

- Fresh approach to digital payments

For Banking Integration: Fonepay

Fonepay works best if you:

- Prefer strong banking integration

- Use QR payments frequently

- Want virtual credit card services

- Value traditional financial institution backing

For Simplicity: Newer Players

Consider MoruPay, PrabhuPay, or other emerging wallets if you:

- Want a simple, no-frills experience

- Are you comfortable with basic features

- Prefer newer, more modern interfaces

- Want to support emerging local businesses

The Technology Behind Nepal’s Digital Wallets

Security Features

All major digital wallets in Nepal implement robust security measures:

- Two-Factor Authentication: SMS or app-based verification

- Biometric Security: Fingerprint and face recognition

- Encryption: End-to-end encryption for all transactions

- Transaction Limits: Daily and monthly transaction limits for added security

Payment Methods

Nepal’s digital wallets support various payment methods:

- Bank Account Linking: Direct bank account connections

- Mobile Banking: Integration with mobile banking services

- Card Payments: Credit and debit card top-ups

- Agent Networks: Physical locations for cash deposits

Interoperability

The Nepal Rastra Bank has been pushing for interoperability among digital wallets, meaning users should eventually be able to transfer money between different wallet providers seamlessly.

The Impact on Nepal’s Economy

Financial Inclusion

Digital wallets have played a crucial role in bringing financial services to previously underserved populations:

- Rural Access: Digital wallets work where traditional banking infrastructure is limited

- Youth Adoption: Younger demographics are embracing digital payments

- Small Business Support: Local merchants can accept digital payments without complex infrastructure

Economic Growth

The digital wallet ecosystem is contributing to Nepal’s economic growth:

- Reduced Cash Dependency: Less reliance on physical cash

- Increased Transaction Transparency: Better tracking of economic activity

- Support for E-commerce: Enabling online business growth

- Remittance Efficiency: Faster and cheaper money transfers

Challenges and Opportunities

Current Challenges

Infrastructure Limitations:

- Internet connectivity issues in rural areas

- Limited smartphone penetration among older demographics

- Power outages affecting digital payment availability

Regulatory Hurdles:

- Evolving regulatory framework

- Compliance requirements

- Cross-border payment limitations

User Education:

- Need for better financial literacy

- Security awareness among users

- Understanding of digital payment benefits

Future Opportunities

Technological Advancement:

- Integration with emerging technologies like blockchain

- AI-powered fraud detection

- Enhanced user experiences through machine learning

Market Expansion:

- Rural market penetration

- Integration with government services

- Cross-border payment solutions

Service Innovation:

- Micro-insurance products

- Micro-lending services

- Investment and savings products

Tips for Choosing the Right Digital Wallet

Consider Your Needs

- Usage Patterns: How often do you make digital payments?

- Service Requirements: What services do you need most?

- Merchant Acceptance: Where do you shop or pay bills?

- Security Preferences: What security features matter most to you?

Evaluate Features

- User Interface: Is the app easy to navigate?

- Transaction Fees: What are the charges for different services?

- Customer Support: How responsive is customer service?

- Reliability: How often does the service experience downtime?

Security Considerations

- Two-Factor Authentication: Always enable 2FA

- Regular Updates: Keep your app updated

- Transaction Monitoring: Regularly check your transaction history

- Secure Networks: Avoid public Wi-Fi for transactions

The Future of Digital Payments in Nepal

Emerging Trends

Cryptocurrency Integration: While still in early stages, there’s growing interest in cryptocurrency integration, though regulatory clarity is needed.

Blockchain Technology: Blockchain could revolutionize cross-border payments and increase transaction transparency.

AI and Machine Learning: These technologies will improve fraud detection, personalize user experiences, and optimize transaction routing.

IoT Integration: Internet of Things devices could enable new payment scenarios and automatic payments.

Regulatory Developments

Nepal Rastra Bank continues to evolve its regulatory framework to balance innovation with financial stability and consumer protection. Future regulations may address:

- Interoperability standards

- Cross-border payment regulations

- Cryptocurrency guidelines

- Data protection requirements

Practical Advice for Users

Getting Started

- Choose Your Primary Wallet: Start with one of the major players based on your needs

- Verify Your Account: Complete KYC requirements for higher transaction limits

- Start Small: Begin with small transactions to get comfortable

- Enable Security Features: Set up PIN, biometric authentication, and transaction alerts

Best Practices

- Keep Apps Updated: Regular updates include security patches

- Monitor Transactions: Check your transaction history regularly

- Use Strong PINs: Avoid easily guessable PINs

- Report Issues Immediately: Contact customer support for any suspicious activity

Maximizing Benefits

- Take Advantage of Offers: Digital wallets often provide cashback and discounts

- Use Multiple Wallets: Different wallets may have better rates for different services

- Stay Informed: Keep up with new features and services

- Refer Friends: Many wallets offer referral bonuses

Looking Ahead: What’s Next for Nepal’s Digital Wallet Space?

The IME Pay-Khalti merger is just the beginning of what promises to be an exciting period for Nepal’s digital payment ecosystem. With increased competition, regulatory support, and growing user adoption, we can expect:

Short-term Developments (Next 6-12 months)

- Integration of IME Pay and Khalti services

- Competitive responses from eSewa and other players

- New feature launches across all major platforms

- Improved interoperability between different wallets

Long-term Vision (2-5 years)

- Comprehensive financial services ecosystem

- International payment integration

- Advanced AI-powered personalization

- Potential for digital currency integration

Conclusion: Embracing the Digital Payment Revolution

Nepal’s digital wallet revolution is well underway, and 2025 has proven to be a pivotal year with the historic IME Pay-Khalti merger. Whether you’re a seasoned digital payment user or just getting started, there’s never been a better time to embrace the convenience, security, and efficiency that digital wallets offer.

The competition between eSewa, the new IME Khalti entity, Fonepay, and emerging players like MoruPay and PrabhuPay ultimately benefits consumers through better services, competitive pricing, and innovative features. As the market matures, we can expect even more sophisticated services that go beyond simple payments to encompass comprehensive financial services.

For businesses looking to tap into Nepal’s growing digital economy, understanding and integrating with these payment platforms is crucial. The companies that succeed will be those that recognize digital payments not just as a convenience, but as a fundamental shift in how Nepalis interact with money and financial services.

The future of digital payments in Nepal looks bright, with technology, regulation, and user adoption all pointing toward continued growth and innovation. Whether you’re team eSewa, excited about the IME Khalti merger, or exploring newer alternatives, you’re part of a financial revolution that’s making Nepal’s economy more inclusive, efficient, and connected.

As we move forward, the key will be choosing the right platform for your needs while staying informed about the rapidly evolving landscape. The digital wallet that’s right for you today might evolve or be complemented by new options tomorrow, and that’s exactly what makes this space so exciting to watch and participate in.